Beneficial Owner Information Report (BOIR) Filing Tips & Tricks

What is BOI reporting and WHY it applies to you!

Virtual Coworking & Entrepreneur Support Workshops

Our Tuesday coworking times are meetups are virtual community spaces and events intended to build and support our community of medical entrepreneurs.

Our virtual (via Zoom) community rooms host a variety of community-building and curiosity-stimulating programming and are open to our cohort of colleagues. Whether you’re looking for some colleague connection while tackling your list of to-dos during our virtual coworking events or looking for practical entrepreneur-directed informations from one of our workshops - join us!

You’ll feel right at home.

Friday, November 19th | BOI Reporting

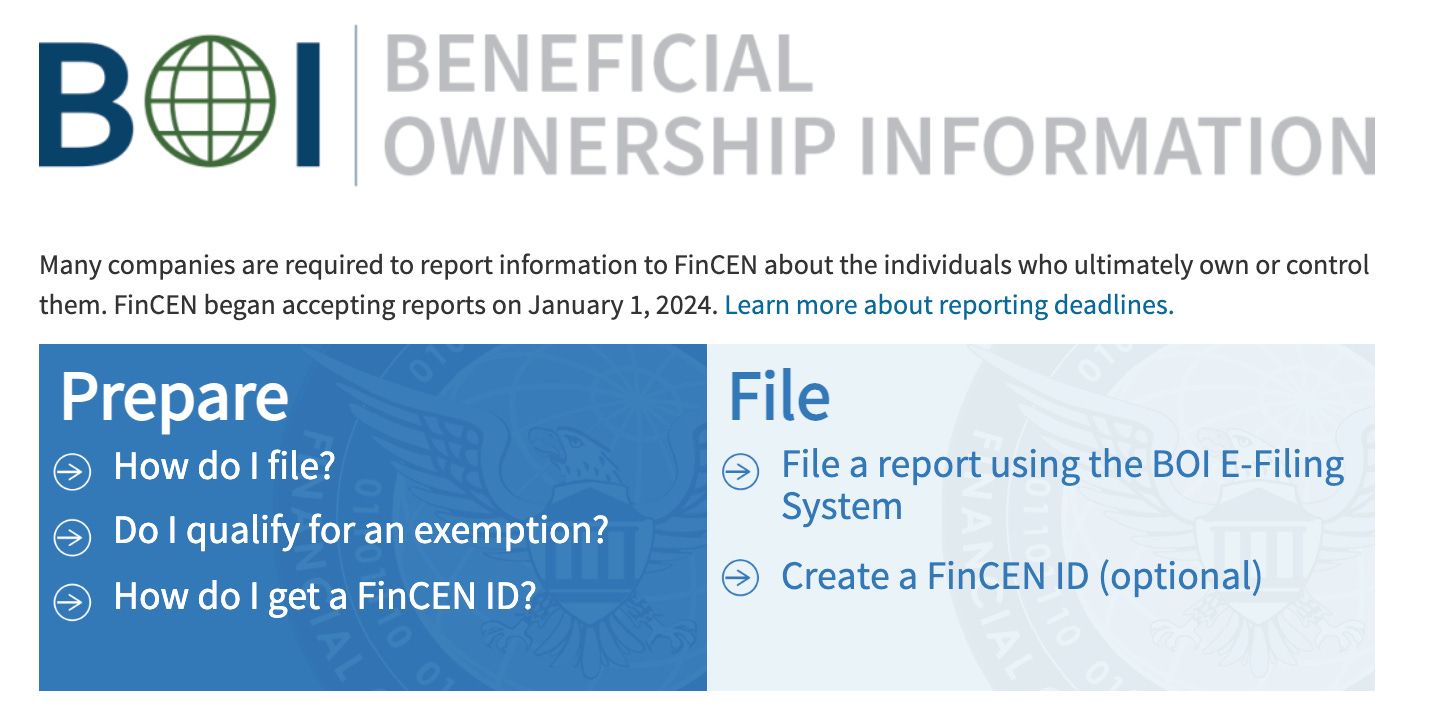

For any single-owner LLCs within the United States - this Beneficial Ownership Information report is a requirement - that means that the majority of the CultivateWellbeing members in our community need to file this report!

This workshop provides some tips, tricks, encouragement, and support to entrepreneurs that want a bit of guidance while working through their report submission.

This presentation, facilitated by Tess Warner of Big Red Dog Business Solutions provides a high-level overview of the background for the Beneficial Ownership Information Report requirement, including:

Origin of the requirement

Who is impacted —> ALL single-owner LLC within the United States

How to file. The presentation slide deck also includes a walkthrough of the filing process for your reference.

Important deadlines!!

Watch the Recording

Cost: FREE!

Glad it’s free … but you’re still called to support and contribute?

Consider making a donation to the Care for the Healer nonprofit in support of the Animals as Healers initiative - a program calling attention to the role of animals as Healers in our families, community, and world.

For business owners interested in looking through the presentation ahead of time and preparing questions for the facilitator, a PDF cody of the slide deck is available here!

Note: this presentation is for single-owner LLCs; businesses with multiple owners or complex structures should seek guidance from their business advisors.

About the Facilitator:

Tess is passionate about helping the veterinary community achieve balance between good business practices, top-notch patient care, and personal wellbeing.

She has worked in a variety of roles throughout multiple industries: Certified Pharmacy Technician, dog trainer for obedience and casual agility, assistant manager in a general practice veterinary clinic, leader of a statewide practice manager organization, general manager of a specialty clinic devoted to canine rehabilitation, contracts professional for a government supply chain/aerospace organization, and manager of a fully-remote veterinary specialty consulting team.

Currently, Tess acts as an operational and management consultant for several smaller veterinary organizations across the US.

Tess lives in Colorado, where she spends her leisure time enjoying the mountains, powerlifting, and pretending her two cats are dogs.

Another interesting update from this facilitator on the BOI reporting requirement:

As of December 26th, BOI reports are not currently required due to ongoing litigation. If you have already filed your report, no action is required. If you have not yet filed your report, you have two options:

1. Voluntarily file your report now. I recommend this; it takes only a few moments to file the BOIR and once you do you no longer have to worry about updates like these.

2. Wait to see what happens with the injunction.

It's very possible the injunction will be lifted and the requirement will be put back in place, but the timeline is uncertain.

Thanks, Tess!

As a followup from the facilitator on a cybersecurity & Vendor Vetting question from this discussion:

Vendor vetting is an entire complex industry unto itself.

There are high-level mandated standards applicable to some organizations but not all small firms will carry those credentials due to the expense.

Some smaller firms may be beholden to particular security requirements/financial standards/data stewardship requirements set by either their state licensing board or the federal government, but it can be difficult to understand these requirements, and doing the research to understand them is likely not worth your time!

I would recommend that any practitioner seeking a lawyer, CPA, bookkeeper, or other vendor handling sensitive business information consider asking the following questions:

1. What safeguards do you have in place to protect your clients' data?

2. Does your firm carry any data governance certifications? Do you carry cybersecurity insurance?

3. Do you have a data security policy at your firm? If so, are you willing to provide a copy of that policy to your clients?

Thanks, Tess, for the followup!